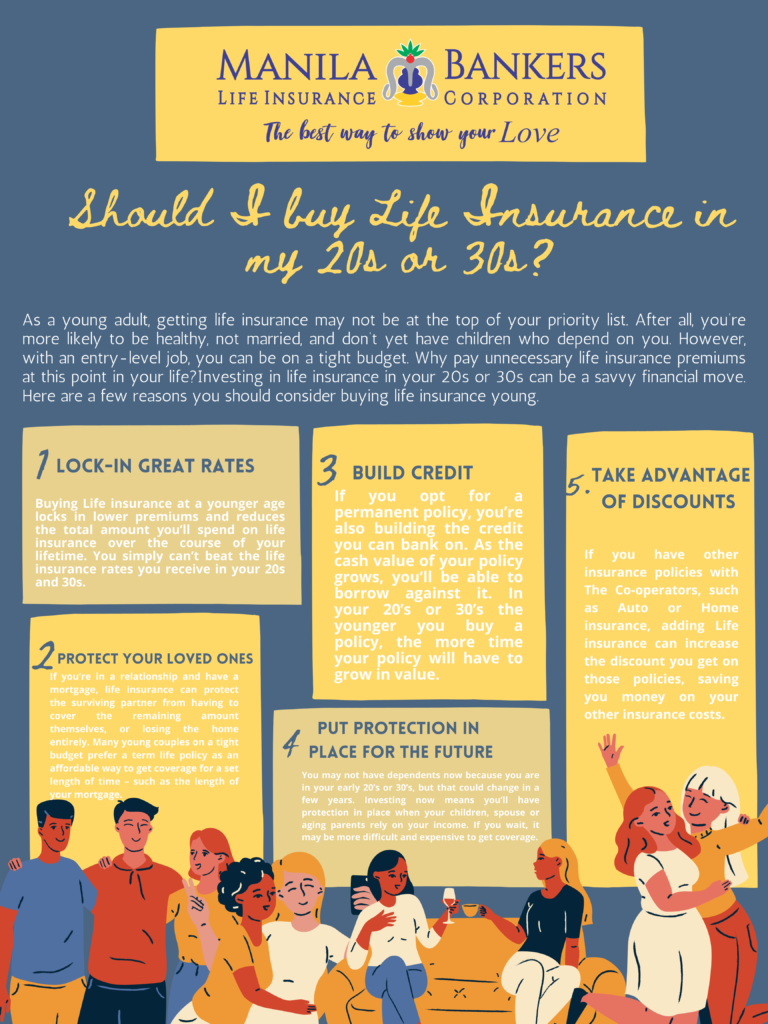

SHOULD I BUY LIFE INSURANCE IN MY 20S OR 30S?

As a young adult, getting life insurance may not be at the top of your priority list. After all, you’re more likely to be healthy, not married, and don’t yet have children who depend on you. However, with an entry-level job, you can be on a tight budget. Why pay unnecessary life insurance premiums at this point in your life?

Investing in life insurance in your 20s or 30s can be a savvy financial move. Here are a few reasons you should consider buying life insurance young.

1. Lock-in great rates

When you buy life insurance, your premiums remain the same for the duration of your policy, unless you change the amount of coverage. Buying Life insurance at a younger age locks in lower premiums and reduces the total amount you’ll spend on life insurance over the course of your lifetime. You simply can’t beat the life insurance rates you receive in your 20s and 30s.

Along with your age, your health is another determining factor in how much you pay for life insurance. Getting insured before any health conditions develop, such as high cholesterol or high blood pressure, lets you lock in very affordable premiums for decades to come.

2. Protect your loved ones

If you were to die, life insurance can protect your parents or loan co-signers from the burden of paying off your debts. If you’re in a relationship and have a mortgage, life insurance can protect the surviving partner from having to cover the remaining amount themselves, or losing the home entirely. Many young couples on a tight budget prefer a term life policy as an affordable way to get coverage for a set length of time, such as the length of your mortgage.

3. Build credit

If you opt for a permanent policy, you’re also building the credit you can bank on. As the cash value of your policy grows, you’ll be able to borrow against it. In your 20’s or 30’s the younger you buy a policy, the more time your policy will have to grow in value.

4. Put protection in place for the future

You may not have dependents now because you are in your early 20’s or 30’s, but that could change in a few years. Investing now means you’ll have protection in place when your children, spouse, or aging parents rely on your income. If you wait, it may be more difficult and expensive to get coverage.

5. Take advantage of discounts

If you have other insurance policies with The Co-operators, such as Auto or Home insurance, adding Life insurance can increase the discount you get on those policies, saving you money on your other insurance costs.

Normally you would need to meet with your insurance company or with your insurance agent to discuss your insurance plan but now, insurance companies are starting to adapt to the online world and revolutionize the industry. One good example of a life insurance company is Manila Bankers Life Insurance Corporation or MBLife. Usually, if you want to track your insurance plan, you’d have to meet with your Manila Bankers Life insurance agent and talk about your concerns about your premiums, your coverage, etc. But now, Manila Bankers has added a tool that is very helpful in today’s world and could help their clients monitor their insurance plan from the palm of their hands.